However, to protect the consumer’s identification, the transaction is performed on behalf of the exchange, not the consumer. Centralized crypto exchanges have come a good distance since they first emerged in 2010, and are actually probably the most widely accepted platforms used to purchase and commerce cryptocurrency safely and securely. It is governed by a centralized authority, which is often the firm that founded it.

These platforms are often used to retailer cryptocurrency and expose traders and buyers to belongings which are otherwise difficult for many people to entry. Centralized cryptocurrency exchanges are on-line platforms used to purchase and promote cryptocurrencies. They are the most typical means buyers use to buy and sell cryptocurrency holdings. For most digital currency traders, the centralized cryptocurrency trade is amongst the most necessary automobiles for transacting. In a centralized trade, the money remains on the trade till you withdraw it. CEXs additionally present custody services for both fiat and cryptocurrencies.

For this, customers deposit belongings into good contracts referred to as liquidity pools. These swimming pools routinely execute trades based mostly on predefined mathematical formulation rather than relying on particular person purchase and promote orders. A centralized trade uses an order e-book system to facilitate crypto buying and selling. It lists all the buy and promote orders, displaying the worth and quantity of each order. An order book records ongoing buying and selling exercise and permits the person to see the current market depth and liquidity. Finally, centralized administration means that firm policy is often opaque–you don’t know the ideas on which the change operates.

The Regulation Of Centralized Exchanges

Choosing the best exchange is dependent upon your investment objectives and threat tolerance. Learn extra about the variations between Centralized vs Decentralized Exchanges. Dollar-cost averaging (DCA) is a strategy where an investor invests a total sum of money in small increments over time instead https://www.xcritical.com/ of suddenly. Erika Rasure is globally-recognized as a leading client economics subject matter professional, researcher, and educator. She is a financial therapist and transformational coach, with a special interest in serving to ladies learn how to make investments.

Here, a consumer usually deposits funds into an account held by the change, which acts as a custodian of those funds. Some exchanges present insurance coverage against theft and network security strategies, while others add deep cold storage strategies that take your keys offline till you need them. Still others use a combination of technologies to attempt to safe your crypto. This signifies that you want to do your homework and learn all of your options before choosing an change. Yet, trading cryptocurrencies carries massive dangers and merchants have to be well-informed about market dynamics.

In the term “centralized cryptocurrency exchange,” the thought of centralization refers to using an intermediary or third party to assist conduct transactions. This is frequent in a financial institution setup, where a customer trusts the financial institution to hold their money. Users can not manage the keys to their cryptocurrency wallets, which is one of the largest minuses of utilizing centralized exchanges. This means that traders are unable to entry their property directly, which can result in large losses and sudden collapses. The centralized exchanges have the authority to freeze or seize your money at any moment since it has the private keys to your wallet.

How Do Centralized Exchanges Work?

The high-risk factor retains some people away from cryptocurrencies as a end result of uncertainties, while others search for volatility and actively participate in buying and selling. With a Ledger system, you can connect with Ledger Live and buy crypto by way of an on-ramp partner. This permits you to purchase cryptocurrencies and shield them together with your Ledger instantly. Put simply, you don’t need to forfeit any ownership of your cryptocurrencies, plus you should purchase and promote cryptocurrencies at will.

The more liquid the exchange is, the easier it’s to trade an asset with out reducing its worth. In the start, CEXs had been anonymous and didn’t ask merchants to reveal who they have been. But as increasingly more folks began utilizing these exchanges, the scenario altered as worldwide monetary regulators grew to worry in regards to the anonymity of the exchanges.

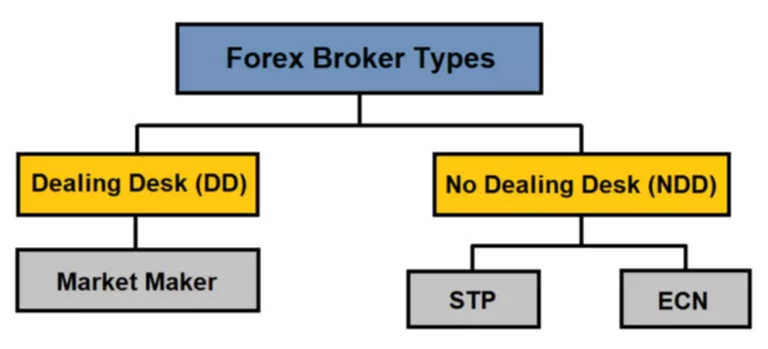

A centralized crypto change is run by a 3rd celebration, monitoring and facilitating transactions and securing property. The exchange provides the required infrastructure for market members to conduct transactions. These transactions are usually settled off-chain on a centralized server the trade operates. If you need to purchase crypto using fiat currency, say USD, you would have to use a centralized change, as most DEXs don’t help fiat currencies similar to dollars or euros. This means to buy crypto for the first time, and you’ll normally want to use a CEX and undergo the KYC course of at some point.

Be Part Of Our Free Newsletter For Day By Day Crypto Updates!

When you deposit cash into your account, the trade ensures its safety. Until you transfer them to your individual wallet, the cryptocurrency remains within the custody of the trade. You can place a “market order” and buy or sell cryptocurrency immediately on the market price. Alternatively, you can place a “limit order” which allows you to set a selected value at which you’d like to purchase or promote an asset. When the value of the asset reaches your set price, the order will execute. Additionally, some exchanges provide specific buying and selling platforms for professional merchants with added functionality like margin trading.

So, when you actually should interact with a centralized change, you don’t have to surrender your possession rights. Coinbase is a centralized cryptocurrency trade that operates in the us and globally. Since many buyers within the space are relatively new to investing in digital currencies, they could be more likely to flip to these sort of exchanges. Some of these exchanges embody Coinbase, Robinhood, Kraken, and Gemini. Generally talking, the upper the levels of trading quantity, the lower the volatility and market manipulation more doubtless to happen on that exchange.

When using a DEX, you merely join your non-custodial wallet to trade crypto and use your individual non-public keys to handle your funds. So what features does an exchange need to have in order to be “centralized”? Users can use ACH and bank wire transfers without a processing fee, though there is still a commission to assume about. Depositing funds by way of Visa and Mastercard is feasible in select areas however — like Coinbase — introduces a really high payment (currently over 4%). Again, using handy fee options like credit score and debit cards could be very expensive, warranting the exploration of more affordable cost methods.

Require Kyc

DEXs typically suffer from poor liquidity and low trading quantity, which represent a significant challenge for their widespread adoption in the blockchain trade. Despite DEXs’ increasing recognition, centralized exchanges stay the easiest and safest method for model spanking new and intermediate crypto users to accumulate and commerce crypto belongings. Centralized cryptocurrency exchanges (CEXs) have come a long way for the rationale that launch of Bitcoin in 2009. Centralized exchanges have performed, and proceed to play, a significant role in the acceptance of cryptocurrency by governments, businesses, and establishments all over the world.

Decentralized exchanges are an alternate; they minimize out the intermediary, producing what is usually thought of as a “trustless” surroundings. Assets are never held by an escrow service, and transactions are carried out totally based mostly on good contracts and atomic swaps. While its number of markets remains limited, there’s centralized cryptocurrency a growing curiosity in the varied trading automobiles dYdX supplies. Moreover, its native Layer-2 protoco, powered by Starkware, for cross-margined perpetuals has higher scaling than the Ethereum blockchain, enabling extra users to discover this selection. That layer introduces zero-gas costs, lower trading fees, and lowered minimal commerce sizes.

Centralized exchanges have performed an essential position in connecting new customers with cryptocurrency, and will remain a viable onramp to crypto because the trade continues to grow. Fees for depositing funds through ACH or different financial institution transfers stay relatively high at 1.49%. Coinbase is a more expensive crypto trade to use and offers restricted choice of cryptocurrencies, though it is also one of the more trusted manufacturers within the business at present.

Customers are required to move KYC (know your customer) passport verification and send photographs of the doc, and a selfie with it confirming identification. Also, utilizing the passport, customers can restore access to their pockets if they’ve lost their password. In this article, we will focus on what centralized exchanges are and how they function. These exchanges are essentially the most most well-liked among regular users since they are the primary way of purchasing digital currencies, significantly for newcomer crypto traders. As a result, CEXs can provide options like advanced buying and selling tools, fiat foreign money assist, simplified account management, and buyer support. This permits them to attract a large number of users and provide higher trading volumes and elevated liquidity which interprets to faster trade execution and tighter bid-ask spreads.

This creates a danger of front-running, market manipulation, or even insider trading. Centralized exchanges will remain a viable onramp to crypto, bringing in new customers as the trade continues to grow. Unlike a CEX, a DEX does not assist custodial infrastructures the place the exchange holds all of the wallet’s personal keys; rather, it permits you to be in control of your funds.